Exactly how to Assess and Select the Right Debt Management Plan Singapore for Your Requirements

Exactly how to Assess and Select the Right Debt Management Plan Singapore for Your Requirements

Blog Article

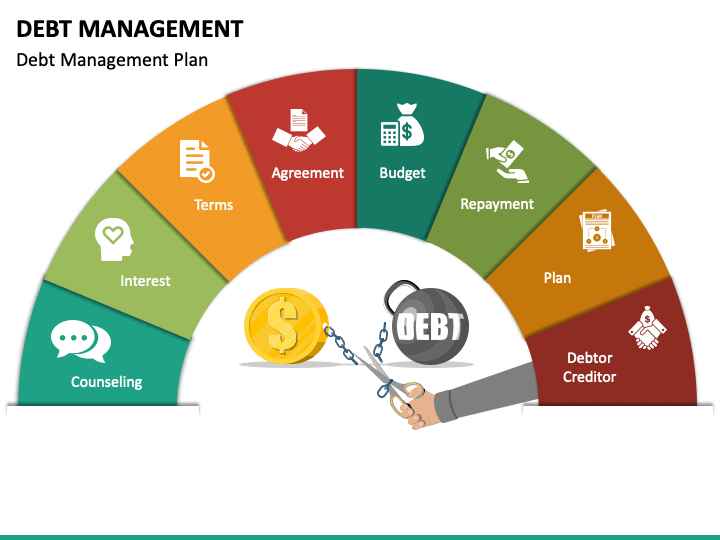

Exactly How a Properly Crafted Financial Debt Monitoring Strategy Can Transform Your Financial Situation

Amidst the obstacles that economic obligations existing, there exists a sign of hope in the type of expertly crafted financial debt monitoring plans. Through a mix of tactical negotiation, economic expertise, and organized preparation, the transformative power of a well-executed financial obligation management strategy can be a driver for reshaping your financial future.

Advantages of a Specialist Financial Obligation Administration Plan

Engaging a specialist debt monitoring strategy can considerably enhance the procedure of tackling monetary commitments with competence and efficiency. This individualized approach enhances the probability of effectively managing and minimizing debt.

Additionally, expert financial obligation administration plans typically feature the benefit of lower rates of interest worked out by the professionals. With their sector expertise and well-known partnerships with financial institutions, professionals can frequently protect decreased rates, bring about general cost savings for the individual. Additionally, these strategies normally include a structured repayment timetable that is a lot more workable for the client, ensuring prompt settlements and progress in the direction of debt reduction objectives.

Personalized Financial Strategy

The production of a tailored economic method is necessary for efficiently decreasing and taking care of financial obligation. A customized economic technique takes into consideration an individual's unique monetary circumstances, objectives, and challenges. debt management plan singapore. By analyzing elements such as income, costs, assets, and financial obligation obligations, a personalized strategy can be developed to resolve particular demands and concerns

One trick benefit of a customized economic method is its capacity to give a clear roadmap for accomplishing financial obligation management objectives. By detailing actionable actions and timelines, individuals can remain focused and motivated in the direction of minimizing their financial obligation concern. Furthermore, a customized plan can also aid people make notified choices regarding budgeting, saving, and investing, consequently improving total monetary health.

A customized plan can be versatile sufficient to accommodate these modifications while still working in the direction of financial debt reduction and monetary security. Inevitably, a tailored economic technique offers as a powerful device in changing one's financial situation and attaining long-term success.

Lower Rate Of Interest and Costs

After developing a tailored economic approach to address individual financial obligation monitoring requires, the following crucial action entails checking out chances to lower rates of interest and fees. Reducing rate of interest rates and costs can considerably impact a person's capacity to repay financial debt successfully. One method to achieve this is by consolidating high-interest financial debts right into a single, lower rates of interest finance. Debt combination can streamline month-to-month payments and decrease the overall rate of interest paid, assisting people save cash in the long run.

Bargaining with creditors is one more efficient approach to lower rate of interest and fees. Several creditors are prepared to discuss reduced rate of interest or waive particular fees if come close to expertly. Choosing equilibrium transfer offers with reduced initial prices can also be a smart move to lower interest expenses briefly.

Moreover, dealing with a trustworthy credit rating therapy company can offer access to financial obligation administration plans that work out lower rates of interest and costs with creditors on behalf of the individual. These plans frequently come with structured repayment schedules that make it simpler for individuals to manage their debt successfully while saving money on interest payments. By actively seeking methods to reduced rate of interest and costs, people can take substantial strides towards improving their economic health.

Combination and Simplification

To improve financial obligation payment and enhance monetary company, exploring loan consolidation and simplification methods is vital for people looking for reliable debt management services. Debt consolidation entails incorporating numerous debts into a single account, typically with a reduced passion price, making it less complicated to manage and potentially decreasing general expenses.

Simplification, on the various other hand, requires organizing finances in a manner that is simple to manage and comprehend. This may entail visit here creating a budget, tracking costs, and setting financial objectives to focus on debt payment. Streamlining financial matters can lower stress and improve decision-making concerning finance.

Improved Credit History and Financial Wellness

Enhancing one's credit rating score and overall monetary health and wellness is a crucial aspect of efficient financial debt monitoring and long-lasting economic security. An expertly crafted debt monitoring plan can play an important role in enhancing these vital areas. By combining debts, discussing reduced interest rates, and producing an organized repayment timetable, individuals can function towards reducing their financial debt problem, which in turn favorably impacts their credit history score. As financial debts are paid off methodically and on schedule, credit score use ratios boost, and a history of timely payments is established, both of which are vital aspects in identifying one's credit rating. browse around this web-site

Additionally, as people abide by the guidelines established forth in a financial obligation management strategy, they develop much better financial behaviors and discipline. This newly found monetary duty not only aids in clearing current financial debts however also establishes a solid foundation for future monetary ventures. By following the customized strategies outlined in the plan, people can progressively reconstruct their creditworthiness and general economic health, leading the method for an extra flourishing and safe financial future.

Verdict

To conclude, a skillfully crafted debt management strategy can dramatically enhance one's monetary scenario by supplying a customized strategy, reduced rate of interest and costs, debt consolidation of debts, and inevitably resulting in a better credit rating and general economic health and wellness. It is a structured method to managing financial obligations that can help people regain control of their funds and work in the direction of a more steady financial future.

With a mix of strategic settlement, economic knowledge, and organized preparation, the transformative power of a well-executed debt administration strategy can be a stimulant for reshaping your monetary future.

To check enhance financial debt repayment and improve economic company, exploring debt consolidation and simplification approaches is essential for individuals seeking efficient financial debt monitoring solutions.Enhancing one's credit scores rating and general economic wellness is a pivotal aspect of effective financial obligation administration and long-lasting monetary security. By combining financial debts, bargaining reduced passion prices, and developing an organized settlement timetable, people can function in the direction of minimizing their financial obligation problem, which in turn positively affects their credit report rating.Moreover, as individuals adhere to the guidelines established forth in a financial debt monitoring strategy, they create better financial behaviors and discipline.

Report this page